If your company had a prior-year tax return outstanding on 30th of June, then your next company tax return is due by the 31st of October.

All the information you need as an individual and/or business owner at tax time!

Company tax returns: What you need to have ready for your accountant

If your company had a prior-year tax return outstanding on 30th of June, then your next company tax return is due by the 31st of October. This means that there may be multiple items that you need to prepare for your company’s return, and the sooner that they’re addressed, the better.

There are certain sections that relate to your company’s taxation affairs that you will need to provide to your accountant so that they can assist you with completing the return on your behalf.

- Income including

- Accounting information, cashbook, assets register, dividend statements, managed funds distributions statements, capital gains statements and more.

- Expenses including details of

- Advertising and marketing expenses, bad debts actually written off during the year, bonuses and commissions paid to employees, or of bonuses and commissions paid to external parties.

- Interest on loan, motor vehicle expenses, donations of $2 and over to registered charities, entertainment expenses, salaries paid, superannuation contributions and more.

- Balance sheet – Assets, including

- Bank statements, CGT assets purchased during the year, leases entered into and terminated during the year, value of stock as at 30 June (and the basis of valuation) and more.

- Balance sheet – Liabilities including

- Accrued expenses and unearned revenue, all loans, the listing of trade creditors with amounts owing, provisions for long service leave and annual leave, and statements from the lending authorities detailing the opening and closing balances of existing loans during the financial year.

- Balance sheet – Equity, including details of

- Any changes to shareholdings, details of loans from shareholders or partners or details of any increases or decreases in reserves.

There may be more items that are required for your particular tax return. In that situation, consulting with your tax adviser is the best step for your business to take to prepare for your next company tax return.

Logbooks for your cars

There are a number of methods that tax deductions can be calculated for car usage or the fringe benefits value of a car. One of these methods requires a logbook to be completed.

The purpose of the logbook is to help determine what proportion of the usage of the car is business use. For an individual, this will then give you a percentage of your overall expenses that are tax-deductible. For an employer, it will tell you what percentage of use of the car is subject to fringe benefits tax. It is important to understand though that even if you complete a logbook, you don’t necessarily have to use the logbook method for claiming your tax deductions.

What goes into a logbook?

Your logbook must contain:

- When the logbook period begins and ends.

- The car’s odometer readings at the start and end of the logbook period.

- The total number of kilometres the car travelled during the logbook period.

- The number of kilometres travelled for each journey. If you make two or more journeys in a row on the same day, you can record them as a single journey.

- The odometer readings at the start and end of each subsequent income year your logbook is valid for.

- The business-use percentage for the logbook period.

- The make, model, engine capacity and registration number of the car.

For each journey, you need to record the:

- Reason for the journey (such as a description of the business reason or whether it was for private use).

- Start and end date of the journey.

- Odometer readings at the start and end of the journey.

- Kilometres travelled.

Other important notes for logbooks

- The log book must be maintained for at least 12 continuous weeks and will be valid for up to five years. If your circumstances change though, you should complete a new log book.

- If you have two cars that you use and wish to keep a log book for both cars, then the 12 week period must be the same for both cars.

- You will need to keep evidence of all of your car expenses (including receipts). You can estimate fuel costs but will need to keep odometer readings.

A logbook cannot simply be written up at the end of the time period (12 weeks). The ATO have access to data (such as toll history) and will match what they find against your logbook. If they discover a discrepancy, all of your car expenses claimed as a tax deduction may be completely disallowed.

What is never tax-deductible?

There are special provisions in tax law that provide that certain items will never be tax-deductible. Even if you feel that you have necessarily incurred this expense in earning your income, they will still not be tax-deductible. In total, there are 35 different items mentioned specifically in this section of tax law, with some of the more common items being:

- Penalties: You cannot claim any fines or penalties that are imposed under any laws (e.g if you receive a parking fine when parking in the city for work-related purposes).

- Payments to reduce your HECS or student debt.

- Travel expenses of a relative when you travel for work-related purposes (unless they are also travelling for their work-related purposes).

- Wages paid to an associate that is more than reasonable for the work they do (e.g. your spouse cannot simply be paid $30,000/year to perform 1 hour of admin work a week for you).

- Payments to maintain your family (this usually applies to farmers, who feed their workers who may also be their family).

- Expenses to obtain or maintain membership of a recreational club.

- Expenses relating to a recreational boat that are more than the income earned from that boat. There is no negative gearing (‘running at a loss’) into a boat unless it is for a real and genuine business.

- Bribes to public officials both here and abroad (even if they had to be paid to get something approved).

- Expenditure relating to illegal activities.

- Superannuation guarantee charge- if you are late in paying your employee’s superannuation you don’t get a tax deduction when you do eventually pay it.

- Interest on borrowings to make non-concessional superannuation contributions.

- Travel expenses related to a residential rental property.

- Expenses associated with holding vacant land

- Where you are required to withhold taxes from certain payments such as interest, royalties or wages and then fail to withhold the required taxes, tax deductions cannot be claimed on these payments.

Some of these expenses are avoidable (such as the superannuation guarantee charge or the failure to withhold taxes from payments). It is important to consult with us to ensure that you are not wasting money on expenses that will not provide you with a valid tax deduction.

Who am I connected to tax-wise?

There are instances throughout tax law where you are required to know who the ‘entities connected with you’ are. This is used in determining if you are a Small Business Entity or what the value of your assets is if you wish to claim the Small Business CGT Concessions. It is also important in instances where you have sold an asset and claimed that it was used by an ‘entity connected with you’.

Sometimes, having an entity connected to you can be a good thing. If you were to sell a factory unit and a company connected with you ran a mechanics business out of that factory unit for example, this would allow you to claim the Small Business CGT Concessions on the sale of that factory unit.

Conversely, the value of the assets of a connected entity are added to yours when looking at certain asset tests. In that sense, you don’t want entities to be connected with you.

If you have a family trust and make a distribution to your adult daughter, you may have to add her assets to your asset pool for determining if you have access to tax concessions. Anyone that has received 40% of the income or capital of a trust in the previous four years is thus connected to that trust.

Two entities that are controlled by the same person or entity are also connected with each other so if you have two trusts that you control, those two trusts are also connected to each other as well as to you.

Interestingly, you and your spouse are not automatically connected to each other, nor would you normally be. If you control a company and your spouse controls their own separate company, then they will most likely not be connected to each other. Depending on the situation, this could be good or bad.

While this may sound complex, your connections are something that needs to be addressed on an ongoing basis. Using the example of the factory unit above, circumstances surrounding its disposal could change the connection. You may have kept the factory unit, but given the company to your son instead five years ago. This means that the company is no longer connected with you which could impact your access to certain tax concessions.

Keeping us apprised of your future plans for your assets and of changes that could impact your connections means that we can ensure that you do not inadvertently miss out on any of the tax concessions that may be available to you.

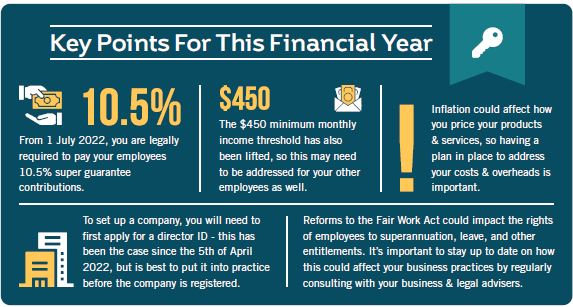

How could your business handle mounting costs as interest rates rise?

As the country’s interest rates rise, so too do the costs for businesses.The spike in inflation (recorded at 5.1% in Q1 of 2022) could provide additional challenges for unprepared businesses across the country. Understanding how and preparing your business for the impact of inflation is an important element of business planning that should be addressed as soon as possible.

Given that there is no expected expiration for how long the current inflation rate will apply, this is something that you may need to plan for in the long term.

Common issues that can impact small businesses as a result of inflation include:

- Increased costs of materials and stock (which can then take months to arrive).

- Fixed-price contracts failing to take into account these costs.

- Increased shipping costs.

- Increased employee costs, with inflation also applying to wages.

While raising prices to address these costs might seem like an immediate solution, it can have a negative impact to customer relationships. The following are simple methods in which your business can address inflation (without potentially alienating customers).

Know where money is currently being spent

Knowing where the money of your business is currently being spent and who in turn is spending it is critical in knowing about how your business is currently sitting, expense-wise. In an inflationary period, it is critical to establish repeatable, end-to-end, actionable visibility of spending by cost category, business process, function, and business unit. You may want to discuss this with your trusted business adviser, who may be able to help you identify these elements better.

Know the difference between strategic & non-strategic spending

One of the key steps is to clearly distinguish between strategic and nonstrategic cost-cutting, the protecting of your signature customer and employee experiences, and fiduciary requirements, for example.

This may involve determining whether the spending for the business is:

- A committed cost, which is spending that is necessary for the business’s operational structure on a long-term basis.

- E.g. Rent, salaries, etc.

- A discretionary spend, which is spending that is not deemed as critical to the running of the business and which can be examined/altered as required.

- E.g. marketing costs, holiday parties, event tickets, and tuition reimbursement.

Rather than completely cut the costs of some of these discretionary spends though, you may be able to consolidate what’s left. Combine activities like training days and celebrations into single events, or combine events across multiple departments. You could also cross-schedule the use of outside resources, such as facilities or trainers.

Why are you spending x amount here?

Why are you spending money in an area that costs too much to run? Knowing the drivers of cost can add up in an inflationary environment to a better understanding of how your business could improve. You should understand the rate that you are currently paying and your consumption for critical cost categories. This is again something that can be discussed with your business adviser.

Doing so should allow you to tailor your business’s approach to inflation by matching current expectations and challenges. This might include addressing issues in purchasing due to the supply chain and produce pricing pressures by choosing ways that allow you to spend better.

Eliminating work & implementing automations

With labor shortages and ballooning labor costs, eliminating the work itself has the greatest impact. This can be done by scrutinising what activities are being performed, how those activities are being performed and what might be easily eliminated through automation.

You may be able to provide services on an optional basis (opt-in versus opt-out), create better processes for your staff to maximise productivity and their value and automate through technologies to free up current staff for other duties.

Here are just a few of the business processes you can automate easily:

- Contract creation and renewals

- General ledger entries

- Purchase orders

- Invoices

- Collections

- Inventory

- Shipping

- Sales and marketing

Lower your supply chain risk

To further hedge against inflation, it is suggested to keep an eye out for tendencies that might make your small business more vulnerable to supply chain disruptions, such as:

- Over-reliance on single suppliers;

- Overseas suppliers that require a long lead time;

- Materials that are challenging or costly to store;

- A single commodity representing more than 10% of the cost of goods sold.

To lower your supply chain risk, try the following:

- Create backup supply chains.

- Search for domestic alternatives to overseas suppliers.

- Stock up on core supplies with minimal storage costs.

- Hedge commodities where appropriate.

What’s new this financial year for superannuation & your business

From the 1st of July, the Super Guarantee rate will have increased to 10.5% of all wages (including some contractor payments). To ensure that you are remaining compliant with this process as an employer, you should make sure that you have made the necessary changes required (for those using payroll software, this should already be accounted for.)’

If your staff are on contracts that are superannuation inclusive you need to decide if they will be receiving a corresponding decrease in salaries or if will you merely be giving them the extra half a per cent of superannuation. If your staff are on a salary or wages that are not described as being inclusive of superannuation then you will need to find that extra half of a per cent. Your first SG payment is not due until 28 October, so there is time to make the necessary changes.

In terms of superannuation and the change in government, Labor has announced that it will not overhaul a “tsunami” of changes to superannuation. This is good news as change only undermines confidence in the existing system.

It is committed to the current program to increase the rate of Super Guarantee up to 12% by 2025 but has stated that it intends to establish a pathway to increase that rate up to 15%.

Labor has also stated that it wants to reform the super guarantee so that it applies to low-income contractors.

The Superannuation Guarantee already applies to many contractors. Any change to increase the rate of payment to a contractor by 10.5% may be met with a corresponding reduction to their payments of 10.5% by their employers. This is because contractors do not have the protection of a minimum wage like other workers. This policy will likely require some consideration and detailed drafting to ensure that it is not abused.

During the 2019 election, one of the policies committed to by Labor was paying superannuation on paid parental leave, a move that could reduce the current ‘gender gap’ in superannuation. This policy has effectively been dropped, but the party does still have an aim to reduce the gender gap currently existing in the superannuation system. At this point, the current plan to address this is unknown, but it has been announced that this may not be something that can be achieved in their first term.

Classifying casual workers compliantly

The meaning of casual employment has evolved and been upheld many times through common law. Under the Fair Work Act, a casual employee is classified as such if they have accepted an offer of employment where there is no firm advance commitment to ongoing work with an agreed pattern of work.

There have been a number of drivers of growth in casual employment over the past several decades including:

- Demand factors, such as employer preferences for a more flexible workforce that can be adjusted quickly in response to changes in operational needs.

- Supply factors including the greater labour force participation of women who may require part-time work to supplement household income and students who desire part-time work to assist them with their costs of living while undertaking study.

- Strong growth in employment in service industries that are more likely to use casual workers, such as hospitality, retail trade and health care and social assistance. There is also evidence of greater use of casual employment among industries that traditionally did not use this form of labour (such as the male-dominated industries of manufacturing, construction and mining).

However, the ability to define someone as a casual worker is something that employers need to be careful with. Are your employees classified as casual employees, but are actually operating more like a contractor? What does a permanent casual entail? How do you know if you are currently compliant?

There are four factors that must be taken into account to determine if an employee is in a casual position:

- Choice: An employer can elect to offer work and a casual employee can elect to accept or reject that work;

- Need: the employee will only work as required;

- Job type: the employment is described as casual employment; and

- Rate of pay: the employee is paid a casual loading (a higher pay rate for being a casual employee), or a specific pay rate for casual employees

Why is this important?

In Australia, more than two million workers are employed on a casual basis.

As of August 2021, 20.9% of casual workers were male and 24.2% female. Overall, casual workers totalled 22.5% of the Australian workforce. Young workers aged 15 to 24 years are much more likely to be contracted on a casual basis compared with those who are aged 25 to 64 years.

So why is it important to classify your workers correctly?

Take, as an example, a labour-hire company that supplies casual workers in the mines. These workers are given the same roster as their permanent full-time counterparts, but at fixed, all-inclusive hourly rates compared to a base salary rate.

This means that those employed as casual workers could receive up to 30-40% less than their permanent counterparts for performing the same or similar work (especially if they missed out on their 25% casual loading as a result of their rate).

A casual worker with fixed hours can become a compliance nightmare for payroll, particularly if awards and rates are not applied correctly, and especially given the legal definition of the type of employment.

How can I as an employer be compliant?

Now is the time for due diligence in assessing your casual employees’ current situations.

Essentially, maintaining compliance with this matter is paramount to ensuring that your current employment and HR processes are working effectively for you and your employees. You need to ensure that:

- At the commencement of employment, your casual employees are provided with a Casual Employment Information Statement (as well as every 12 months after).

- Your current employment agreements reflect that casual employees do not have ‘a firm advance commitment to ongoing work’ and meet the specific criteria outlined in the definition of a casual employee to make sure that they are correctly classified.

- These employee contracts should specify whether an employee is casual, whether they can elect to accept or reject the hours and whether they are paid a casual loading.

- There is clear casual to permanent conversion frameworks in place in your business (if you are not a small business), with clear processes ready to identify employees that may be entitled to convert to permanent employment.

- Casual workers should also have superannuation contributions paid by their employers if they are over 18 years old (even if they earn less than $450 per month) or if they are under 18 years old and work more than 30 hours per week.

Casual employees must be offered a conversion to full or part-time permanent employment under the National Employment Standards if:

- They have worked for the employer for a 12 month period;

- They have worked a regular pattern of work on an ongoing basis for at least the past 6 months; and

- The employee could continue to work their regular hours as a permanent employee without significant adjustment.

Employees are required to respond in writing within 21 days as to whether they accept or reject the offer. If they reject the offer (or don’t respond) they continue to be casual.

If your employee accepts the offer, you must discuss the terms with the employee and confirm them in writing within 21 days. The commencement date must be the first day of the employee’s next full pay period after that notice unless the parties agree otherwise.

Incorrectly classifying your employees can lead to major compliance issues and result in significant penalties if caught. Talk to a trusted adviser or speak to a legal professional about your employment agreements today.