This summer newsletter edition covers all you need to know about the 2022-2023 Federal Budget announcements, why a Directors Identification Number (ID) is so important & how to keep your clients information safe!

The consequences of not having a Director Identification Number (DIN) when setting up a company

Why are director ID’s important?

Unique and individual identifiers, Director Identifications aim to combat ‘phoenixing’, which involves transferring the assets of an indebted company to a new company with the goal being to avoid paying the indebted company’s liabilities deliberately. This act is illegal because it places unsecured creditors and employees in a position where they may not be able to recover money owed by the company.

It is believed that Director Identification Numbers will better equip regulators and external administrators to track failed companies’ directors and increase corporate sector accountability.

Who needs a director ID?

New directors must apply for a Director Identification Number at least a day before registering the company. For those who were existing company directors before 5th April 2022, this needs to be put into place as it became a legally mandatory requirement of company directors. However, once applied for, that Director Identification number is their’s for their entire lifetime as a director.

What happens if I don’t have a Director Identification Number (DIN)?

Any director (or alternate director) who fails to comply with the new rules surrounding Director Identification Numbers may be liable for civil and criminal penalties. A contravention of the Director Identification Number rules occurs, among other things, where a director:

- Fails to obtain a DIN;

- Fails to apply for a DIN within the required time frame; or

- Provides false or misleading statements.

If a director is caught contravening these rules, penalties will be enforced as these are strict liability offences.

More serious criminal or civil liabilities may arise if a director applies for multiple Director Identification Numbers, provides false or misleading information in their application, or misrepresents their Director Identification Number to a Commonwealth body, registered body or company. These offences carry significant civil and criminal penalties, including terms of imprisonment.

| Offence | Maximum penalties for individuals |

| Failure to have a director ID when required to do so | $13,200 (criminal); $1,100,000 (civil) |

| Failure to apply for a director ID when directed by the Registrar | $13,200 (criminal); $1,100,000 (civil) |

| Applying for multiple director IDs | $26,640, 1 year imprisonment or both (criminal); $1,100,000 (civil) |

| Misrepresenting director ID | $26,640, 1 year imprisonment or both (criminal); $1,100,000 (civil) |

What do I need to do?

As a company director, it is your responsibility to have a Director Identification Number or to apply for one.

When people must apply for their Director ID depends on when they first become a director:

- Directors appointed before the 1st of November 2021 have until the 14th of November 2022 to apply.

- New directors appointed for the first time between the 1st of November 2021 and the 4th of April 2022 had 28 days from their appointment to apply.

- From the 5th of April 2022, intending new directors must apply before being appointed to the company, or before the company is registered. If you require more information about your requirements as a director, you can speak with us.

2022-2023 Federal Budget: Tax announcements

The 2022-23 October Federal Budget was handed down with several announcements involving tax.

These tax-related Budget measures included:

Intangible assets depreciation

There was a reversal of the previously announced option to self-assess the effective life for certain intangible assets (for example, intellectual property and in-house software), and instead, will continue to be set by statute.

Digital currencies will not be classed a foreign currency

Legislation will be introduced to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency.

Denial of deductions for payments by “significant global entities” for intangibles

An anti-avoidance rule will be introduced to prevent significant global entities (entities with global revenue of at least $1 billion) from claiming tax deductions for payments made directly or indirectly to related parties concerning intangibles held in low- or no-tax jurisdictions.

COVID grants treated as NANE

The latest Budget lists certain State and Territory COVID-19 grant programs eligible for non-assessable, non-exempt treatment.

Penalty unit increase

The amount of the Commonwealth penalty unit will increase from $222 to $275 from 1 January 2023. A penalty unit is what the fines the ATO issues are comprised of. For example, a failure to lodge penalty for small entities is calculated at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of 5 penalty units.

Off-market share buy-backs tax treatment

The tax treatment of off-market share buy-backs undertaken by listed public companies will be aligned with the treatment of on-market share buy-backs. Current rules around share buy-backs by companies off-market mean that a proportion of the consideration for off-market purchases is treated as a dividend. However, the change will make that entire consideration for off-market buy-backs to be treated as capital proceeds, with no associated franking credits.

Additional funding to the tax avoidance taskforce

The Taskforce will continue to be focused on compliance activities that target multinationals, large public and private groups, trusts and high-wealth individuals. The government has announced a further $200 million in funding per year for the next three years to extend the Taskforce and, in 2025-26, there is to be a significant increase of $534.5 million for that year.

Privacy of your client’s information in the wake of the Optus data breach

Australia has the opportunity to be at the forefront of privacy and data protection, with laws and practices that increase consumer trust and confidence in the protection of personal information and underpin innovation and economic growth.

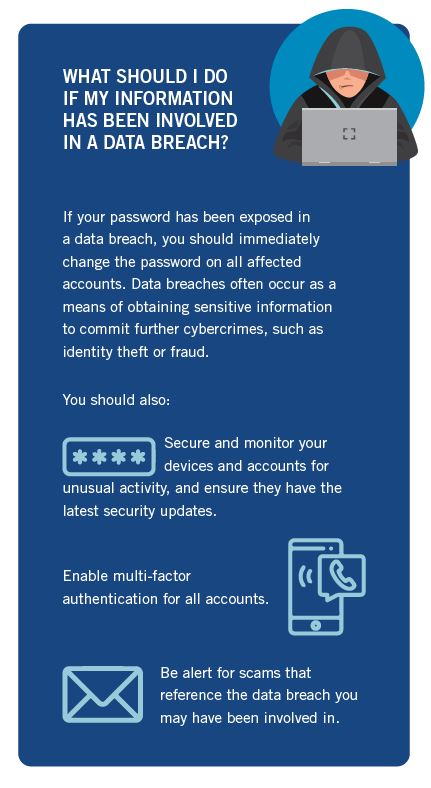

How do data breaches occur?

A data breach occurs when the data for which your company/organisation is responsible suffers a security incident resulting in a breach of confidentiality availability or integrity.

Here’s how a data breach can occur:

An accidental insider: An example would be an employee using a co-worker’s computer and reading files without having the proper authorization permissions. The access is unintentional, and no information is shared. However, because it was viewed by an unauthorized person, the data is considered breached.

Lost or stolen devices: An unencrypted and unlocked laptop or external hard drive — anything that contains sensitive information — goes missing.

A malicious insider: This person purposely accesses and/or shares data with the intent of causing harm to an individual or company. The malicious insider may have legitimate authorization to use the data, but the intent is to use the information in nefarious ways.

Malicious outside criminals: These are hackers who use various attack vectors to gather information from a network or an individual.

What happens if a company’s data is breached?

When an organisation or agency that the Privacy Act 1988 covers have reasonable grounds to believe an eligible data breach has occurred, they must promptly notify any individual at risk of serious harm. They must also notify the Office of the Australian Information Commission.

Smaller and medium-sized businesses can be especially vulnerable to cyber security threats. This is because:

- They often don’t think they will be targeted and therefore aren’t prepared.

- They can have outdated systems or a lack of security protocols and training, which make them easier to hack.

- They are less likely to have large, dedicated IT teams who can stay on top of the latest IT security risks and website security issues.

An eligible data breach occurs when the following criteria are met:

- There is unauthorised access to or disclosure of personal information held by an organisation or agency (or information is lost in circumstances where unauthorised access or disclosure is likely to occur).

- This is likely to result in serious harm to any of the individuals to whom the information relates.

- The organisation or agency has been unable to prevent the likely risk of serious harm with remedial action.

Under the Notifiable eData Breaches (NDB) scheme any organisation or agency the Privacy Act 1988 covers must notify affected individuals and the OAIC when a data breach is likely to result in serious harm to an individual whose personal information is involved.

PAYG withholding or PAYG instalments?

As a taxpayer, you may have come across the term pay-as-you-go (PAYG).

PAYG is generally a good thing, but there can be confusion between PAYG withholding and PAYG instalments, particularly if you’re an individual who is eligible for both. Both are amounts by which your tax bill at the end of the financial year can be offset.

So there’s no need to worry – the ATO is not stealing your money. Here’s how to distinguish between the two types of PAYG you may have encountered as a taxpayer.

PAYG withholding

As an employer, you have a role to play in helping your payees meet their end-of-year tax liabilities. You do this by collecting pay-as-you-go (PAYG) withholding amounts from payments you make to:

- Your employees;

- Other workers, such as contractors that you have voluntary agreements with;

- Businesses that don’t quote their Australian business number (ABN).

This is to assist in minimising the impact of your employee’s tax bill at the end of the financial year. If you’re an employee, there’s no need to worry about this amount – it is what is used to work out how much tax you may owe or be owed by the Australian Taxation Office at the end of the year.

Payments other than income from employment may also need tax withheld, including:

- Investment income to someone who does not provide their TFN.

- Dividends, interest and royalties paid to non-residents of Australia.

- Payments to certain foreign residents for activities related to gaming, entertainment and sports, and construction.

- Payments to Australian residents working overseas.

- Super income streams and annuities.

- Payments made to beneficiaries of closely held trusts.

PAYG instalments

Pay-as-you-go (PAYG) instalments are regular tax prepayments on your business and investment income.

They’re a way to offset your tax bill at the end of the financial year by paying regular instalments. This way, you should not have a large tax bill when you lodge your tax returns.

If your financial situation has changed, your expected tax may also change. This means your current PAYG instalments may add up to more or less than your tax at the end of the year.

When do you have to pay PAYG instalments?

If you are an individual (including a sole trader) or trust, you will automatically enter the PAYG instalments system if you have all of the following:

- Instalment income from your latest tax return of $4,000 or more;

- Tax payable on your latest notice of assessment of $1,000 or more, and;

- An estimated (notional) tax of $500 or more.

A company or super fund will automatically enter the PAYG instalments system if any of the following apply:

- It has instalment income from its latest tax return of $2 million or more;

- It has an estimated (notional) tax of $500 or more, or;

- It is the head company of a consolidated group.

PAYG varying instalments

You can vary your PAYG instalments if you think your current payments will result in you paying too much or too little tax for the income year. Variations must be made on or before the payment due date (28 days after the end of each quarter, generally).

You do not have to vary your PAYG instalments at all. It will not change how much income tax you pay for the year.

After you lodge your tax return, if your instalments were:

- Too high, the excess is refunded to you;

- Too low, you pay the shortfall.

Your varied amount will apply for all your remaining instalments unless you make another variation before the end of the income year.

You might need to vary your PAYG instalments if the 2022 floods or other disasters impacted you.

If you cannot pay your instalment amount, you should still lodge your instalment notice and discuss a payment arrangement with the ATO. You may wish to obtain advice from a tax agent on whether you should vary your instalments.

Electric car modelling for your business

Key tax measures regarding electric vehicles have been announced for businesses who may be looking to purchase a new car, but how do you know if buying electric is the right move for your business?

You may have wanted to provide electric vehicles to your employees or your business or are an employee wishing to salary-package an electric vehicle. The implications of fringe benefits tax have been a key issue in the purchase and rollout of electric vehicles for businesses.

The Treasury Laws Amendment (Electric Car Discount) Bill 2022 was introduced as an amendment to the Fringe Benefits Tax Assessment Act 1986 to exempt from FBT the use of eligible electric cars made available by employers to employees.

This FBT exemption will apply to battery electric cars, hydrogen fuel cell electric cars and plug-in hybrid electric cars.

To be eligible for the tax exemption, an electric car’s value must be below the luxury car tax threshold. For 2022-2023, the threshold for fuel-efficient vehicles is $84,916.

Accountants can be effective tools that your business can use to make an informed decision about potential outcomes resulting from a decision-making process.

In this case, is purchasing an electric car cost-effective and of taxable benefit to your business?

Accountants undertake a process known as financial modelling, which is the interpretation of numbers associated with features of a company’s operations. This means they build an abstract representation using data and numbers of a real-world financial situation to determine whether the outcome will benefit the business (usually for tax purposes).

For example, if it was thought that purchasing an electric company car could be potentially more tax effective than your current company car (even if you had purchased or leased that car within the last 12 months), accountants can ‘run the numbers’ to validate the decision.

Your accountant should provide you with the information to make an informed decision that still advises you on the best options for the business. Please note that your accountant will not

For more information about the EV exemption, consult with your adviser today.

New generation of expectations from workers & consumers

Businesses must accommodate the new expectations from workers and consumers stemming from the social norms that have influenced them.

These new generations have different expectations of how they, as workers and consumers, expect to be treated, and a good business should try to accommodate these expectations.

Worker expectations

Happiness

Prospective and current employees expect their workplaces to aim towards a corporate culture that accommodates their happiness as individuals alongside their worth as

a business asset. The current generation of workers has specific ideals for the businesses they work for, ranging from ethical, social and even environmental considerations.

Flexibility

Workers are looking for the freedom to choose a working environment that considers their needs and expectations while balancing a healthy work/life balance.

Is work-from-home/hybrid/remote working an option? Is a four-day workweek viable?

Flexible working options have become a staple of many jobs (where it’s plausible), so being too inflexible about them concerning your employees can have negative effects. Putting this into perspective, about 45% of 25 to 34-year-olds say they wouldn’t accept a job that didn’t offer schedule flexibility. and 41% say the same about jobs lacking remote opportunities

Learning & development options – Upskilling

Good workers want to learn more about their jobs and the skills they need to maintain. A good employer facilitates this development by providing the specific training that workers need to excel in their professional roles at the business.

Providing attainable learning goals amidst opportunities enables them to quickly and easily acquire the skills they need to do their jobs better daily. Having a choice of learning and the resources to enable skilling priorities will help build workforce confidence and loyalty.

Expectations from consumers

Strong communication

Customers expect consistent interaction across your business’s departments (from marketing to sales to support/service) and for the communication to be consistent and effective. Failing to share information across those channels can hinder potential transactions (e.g. promoting a sale through marketing channels that the sales teams do not have awareness of).

Personalisation

Customers expect you as a business to understand their unique needs and expectations, without treating them as a statistic. Personalise special offers to them that promote their loyalty/continued subscription to your services, e.g. 50% off the last product when purchasing 3 or more.

Data protection

Amidst the Optus leak, data protection should be a number one priority for businesses, and customers should feel secure that you are doing everything possible to keep their data safe. Make their trust your priority, and be as transparent as transparent as possible about how you are using their data.

From 5th April 2022, Director Identification Numbers (DINs) have been a mandatory requirement for company directors. However, if you have yet to apply for a DIN as a director and have started up a company, you could face significant consequences and penalties, including potential imprisonment.