Tax cuts have been a recurring topic in political discussions, often shaping fiscal policies and influencing government revenue. The Stage 3 tax cuts introduced by the Morrison government in 2019 have been a point of contention and scrutiny, with promises and commitments surrounding their implementation. In this article, we aim to provide an impartial overview of the Stage 3 tax cuts, highlighting key aspects and the proposed changes by the Albanese Labor Government.

The Albanese Labor Government’s changes

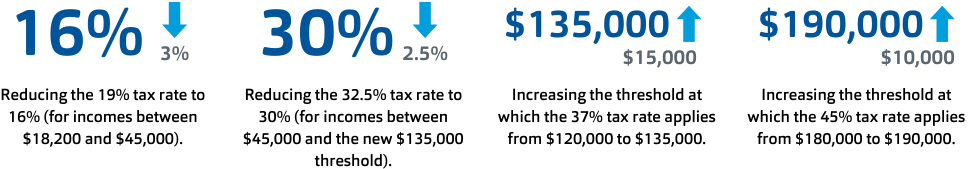

From July 1, 2024, the Albanese Labor Government has outlined several adjustments to the tax system. These proposed changes include:

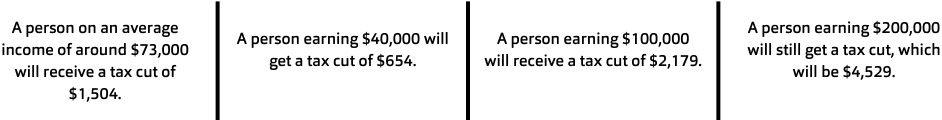

As a result of these changes, all 13.6 million taxpayers are expected to receive a tax cut. The proposed tax cuts aim to provide relief to a broad spectrum of taxpayers, from those with average incomes to higher-income individuals.

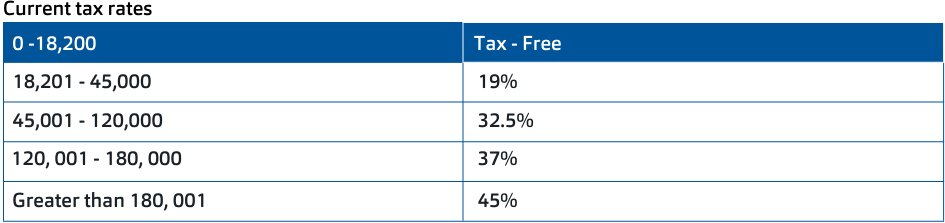

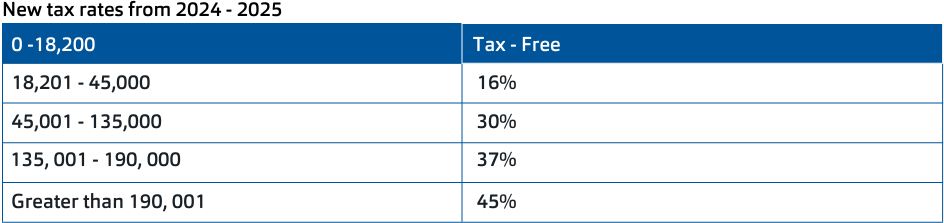

New personal tax rates & thresholds for 2024-25

Comparative tax cut figures

Under the current plan, the tax cuts are projected to be as follows:

The Stage 3 tax cuts have been a focal point of tax policy discussions, with implications for individuals across various income brackets.

The Morrison government’s initial implementation and Labor’s commitment to maintaining and adjusting these cuts demonstrate the complexities involved in shaping tax policies. As changes are proposed and debated, it is crucial for taxpayers to stay informed about how these policies may impact their financial situations.