The latest SDA (Specialist Disability Accommodation) Price Review released in June this year increased the SDA vacancy assumption from 3% to 10% (initial pricing model) to 7.75% to 13%.

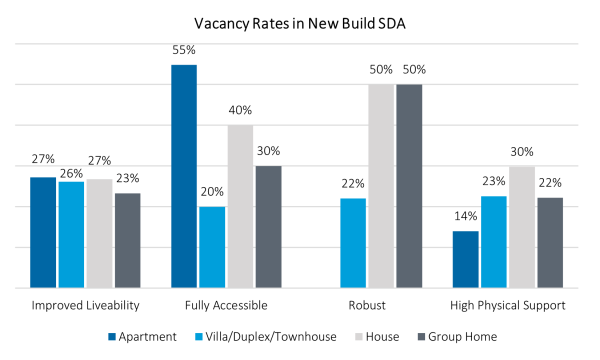

The NDIS funds SDA vacancies for a maximum of 60 days for dwellings enrolled to house two / three residents and 90 days for dwellings enrolled to house four / five residents, with no vacancy payment available for dwellings enrolled to house a single resident. The latest SDA Price Review released in June this year increased the SDA vacancy assumption from 3% to 10% (initial pricing model) to 7.75% to 13%. The assumed vacancy rates increased across all build types in the latest Price Review, however, are in stark contrast to recent data released in Housing Hub’s Provider Experience Survey showing a total vacancy rate of 25.5% across New Build stock. The Survey results showed vacancy to be highest in houses (30.9%) and group homes (22.2%) and for Fully Accessible (39.5%) and Robust (33.7%) design types.

This brief report summarises some of the key themes that have emerged in our research and conversations with industry experts that help to explain SDA vacancies.

- Administrative issues on the NDIA side

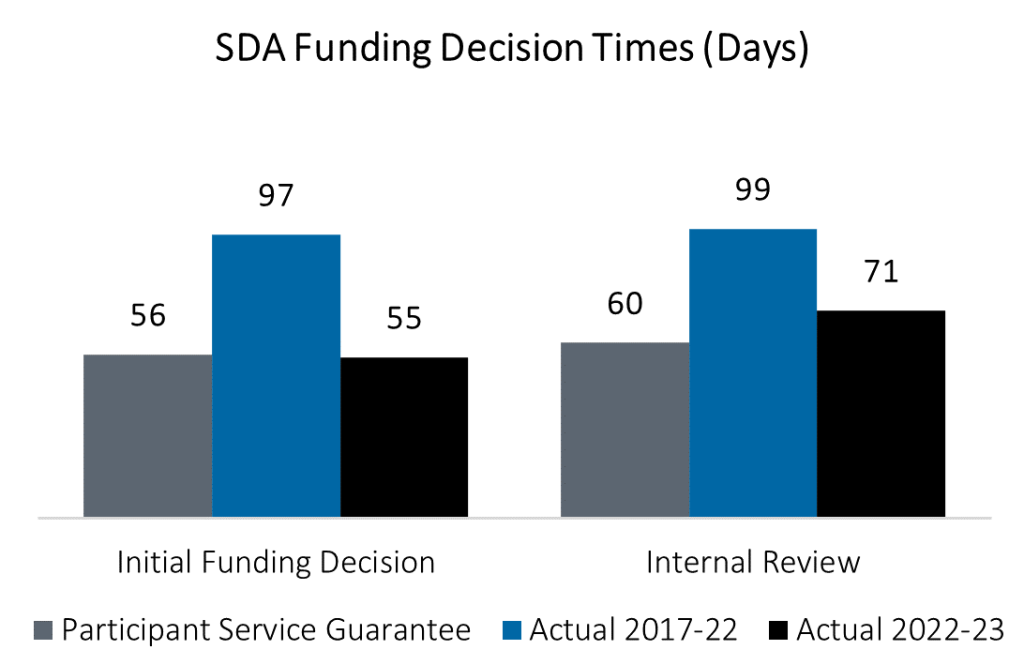

- The NDIA has a Participant Service Guarantee that states that participant plans should have a maximum wait time of 56 days, with an internal review period of 60 days if the NDIA decision does align with the participant request.

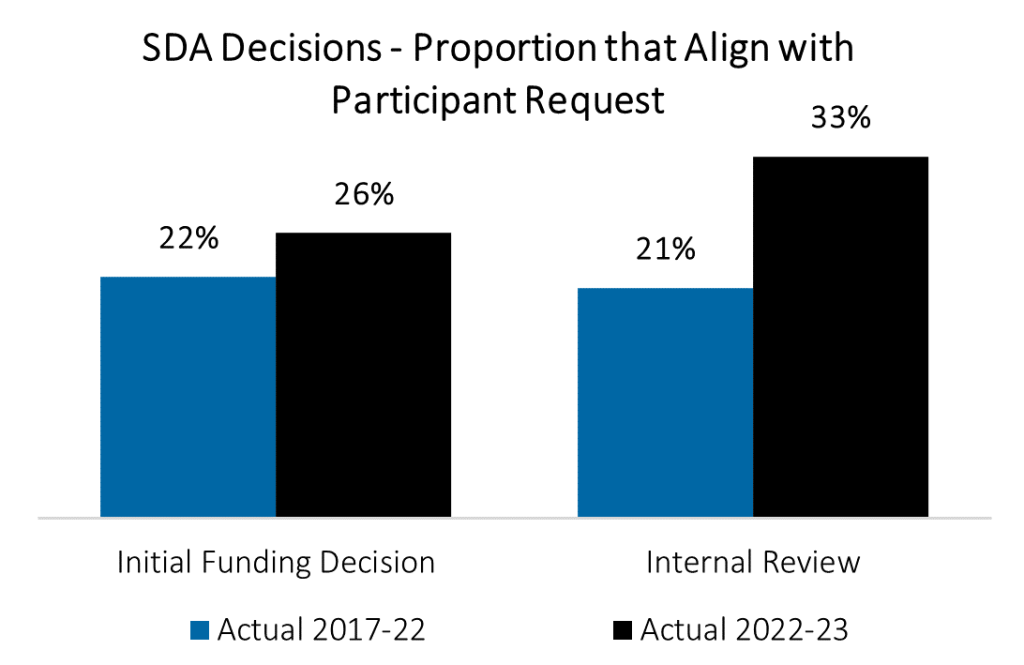

- Despite sizeable improvements over the past year, recent data shows that the time between submitting an initial SDA request and receiving the funding requested can still take many months. According to the Public Interest Advocacy Centre and Housing Hub (sourcing data provided by the Housing Hub’s Tenancy Matching Service (TMS)), the median wait time of initial funding decisions was 71 days for decisions in 2022-2023, improving from 97 days between 2017 to 2022. The median internal review time was 55 days in 2022-2023 (down from 99 days) and the median time of an external review was 125 days in 2022-2023 (down from 205 days). NDIA SDA funding decisions were also slightly more aligned with participant requests in 2022-2023 than they were between 2017 and 2022.

- Whilst wait times and the rates of inappropriate SDA funding decisions improved in 2022-23 compared with 2017-22, there is still room for improvement and enhanced transparency regarding funding decisions. We note that for external reviews supported by the TMS between 2017 and 2023, 92% of participants received their initial requested funding, 7.7% withdrew their application and 1.3% were not approved. However, because the entire decision process of someone requesting an internal and external review can take more than 250 days, and due to the financial and emotional pressure the process can involve, most participants who receive an unfavourable internal review decision due not request an external review.

- The 2023 Provider Survey found that 62.5% of SDA providers viewed the time the NDIA takes to make SDA decisions as “extremely challenging”. A further 25.0% of providers rated it as “moderately challenging”. Over half of the providers surveyed (55.3%) found the time that the NDIA takes to make support decisions as “extremely challenging”. Circa 46% of providers surveyed stated that tenants receiving an SDA determination that is not aligned to their housing preference or the evidence provided was “extremely challenging”.

- Lengthy timeframes for SDA and support decisions can result in SDA properties sitting vacant for extended periods despite there being evidenced demand from participants caught up in what can be a lengthy and seemingly erroneous process of funding approval.

- Poor investment decisions of developers

- The NDIA reviews the benchmark pricing (funding) for SDA every five years. The Pricing Reviews are undertaken to evaluate the impact that the previous SDA funding prices had on the supply and demand of SDA housing, with the intention to guide market investment and the construction of new dwellings to be in-line with demand.

- The SDA Pricing Review released in June this year commented that “some vacancies should be attributable to oversupply in some areas and may reflect poor investment decisions that should not be incentivised”.

- Whilst the market continues to mature, our experience indicates that there are some unsophisticated developers, with a lack of understanding of the complexities involved in SDA dwellings, operating in the SDA market. We have heard of investors chasing the highest level of funding (single participant / High Physical Support), without regard to market demand; developing product that is not fit-for-purpose or matched to participant needs; and developing product in undesirable locations where land is more affordable.

- The Provider Survey found that 48.8% of providers found it “extremely challenging” to find tenants with the appropriate level of SDA in their NDIS plan.

- We believe that the poor investment decisions of some developers have contributed in part to high vacancy levels and difficulties filling dwellings, and that this will only become more evident over coming years as higher-quality stock is developed.

- Insufficient supply and demand data

- The lack of detail and transparency on SDA supply and demand data impacts a provider’s ability and confidence to develop the right product in the right location resulting in stock being developed which is potentially unsuitable for participant needs and demand.

- Providers in the 2023 Provider Survey were vocal that the level of transparency provided by the NDIA regarding supply and demand is lacking. Whilst we acknowledge that there are some inexperienced investors in the market, we are also cognizant that the level of detail in the supply and demand data released by the NDIA is insufficient for some investors to make informed decisions. This could also contribute to the previously noted finding that close to 50% of providers found it “extremely challenging” to find tenants with the appropriate level of SDA in their NDIS plan.

- The Provider Survey noted that improving the transparency of the data, particularly in relationship to developments underway is a concern of some providers, and that “it is critical that the NDIA, as part of its stewardship role, improve access to much-needed market data”.

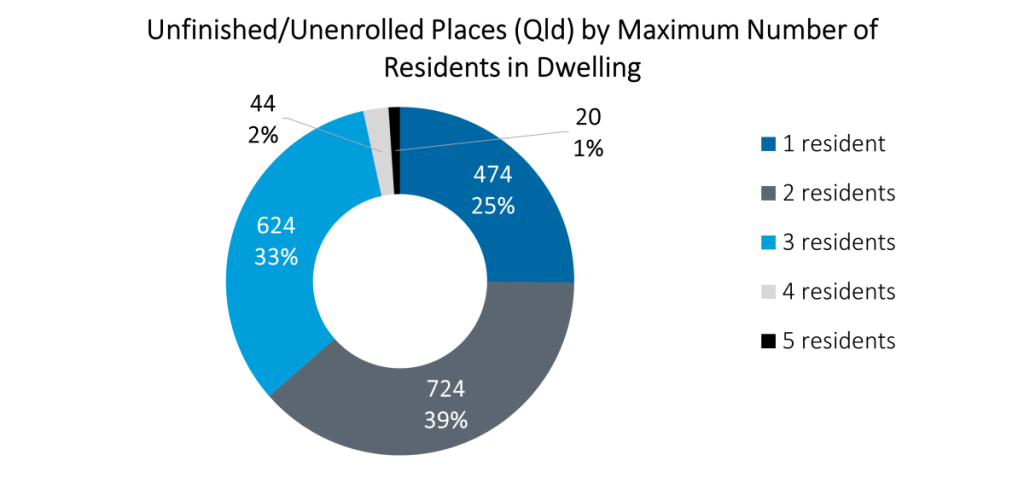

- As part of the quarterly update, the NDIA provide data on unfinished/unenrolled dwellings, however, only at the SA4 level and with no details on the status of the dwelling. The NDIA have noted that works are underway to improve the accuracy of unenrolled SDA dwellings reporting.

- Insufficient supply and demand data from the NDIA, particularly relating to developments underway may result in some SDA properties being developed in oversupplied areas or areas without sufficient demand.

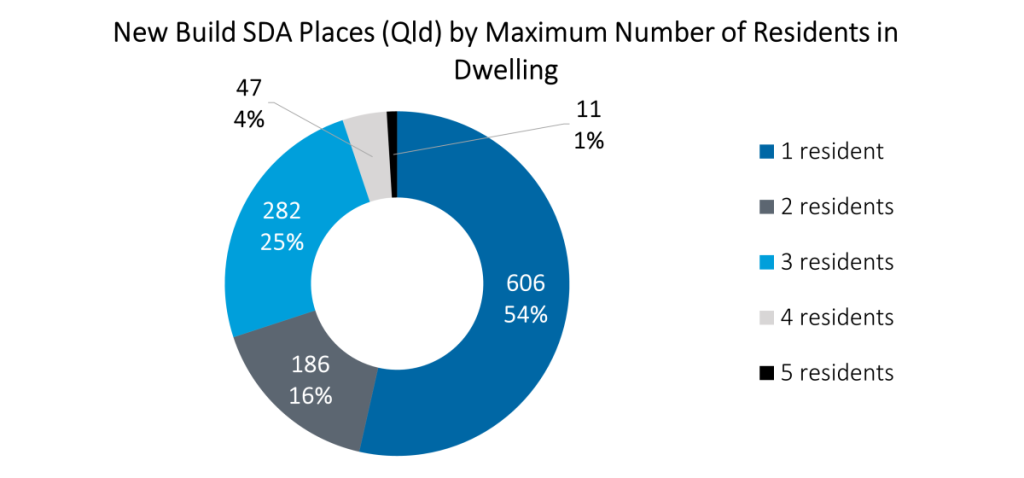

- Stock options, participant demand and participant funding incongruence

- A central goal of the NDIS is participant ‘choice and control’ and most NDIS participants seeking SDA have specified that they would prefer to live in a single-resident dwelling. As of the June 2023 quarter, circa 54% of new build places were in single-resident dwellings and just over 25% of unfinished/unenrolled places were single-resident dwellings. However, recent reports show that funding for independent living is not regularly approved, potentially explaining the prevailing high vacancy rates in new build dwellings. This could also result from providers building to participants demand, before funding has been approved.

- Furthermore, the average annualised payment for SDA (existing and new build) was $17,000 during the June quarter and is substantially lower than new build funding suggesting that participants are simply not receiving high enough funding for new build accommodation. We note that the lower vacancy rates in High Physical Support dwellings are likely a result of vacancies in these dwellings being absorbed by participants with lower levels of funding (as participants with any level of funding can reside in High Physical Support).

- Some providers in the Provider Survey commented that the NDIA should consider expanding the building configurations that are funded. For example, providers commented that participants funded for Robust dwellings often need independent living due to the nature of their disability, however, this is rarely funded. The Survey showed a vacancy rate of 22% in Robust villa/ duplex/ townhouse dwellings (noting that villas are the only dwelling type funded for single resident Robust participants), yet vacancy rates of 50% for Robust houses and group homes.

- Outlook – SDA vacancies, investment demand and funding

- SDA has been viewed as a favourable investment class as it was seen to be underwritten by Government funding that was, to some degree, guaranteed by federal government support for a previously neglected community service / need. The recent changes to funding, coupled with heightened awareness of vacancies in the industry, have resulted in growing understanding of the downside risk to both revenue and investment certainty going forward.

- Prolonged vacancies result in providers receiving lower income than anticipated, impacting market sentiment and developer confidence. According to the recent Provider Survey, 78% of providers received lower income than expected for at least some of their SDA properties.

- Increased market uncertainty will result in some yield softening to account for the additional risk associated with future maintainable earnings, as well as potentially reduced funding options for SDA investment properties and projects.

- In addition, it is expected that funders will be more selective of individual investments going forward and may choose to reduce their exposure to those providing-lower quality accommodation. Properties have a lower risk profile once participants have been identified and their funding approved.

- Investors, whether privates or institutional, should only be relying on the NDIS funding guarantee, not government bailouts or vacancy support.

- We note that the new pricing introduced mid-year should help lower the vacancy rate in some segments of the market, such as for well-designed and well-located Improved Liveability dwellings.

- Designing dwellings which are fit-for-purpose has always been important, but it has now become imperative in securing and maintaining tenants. Close to 25% of SDA funded participants in Queensland are seeking an alternative dwelling and as participant relocations become more common, vacancy is expected to rise in lower-quality dwellings.

Vacancies in the Specialist Disability Accommodation sector

This brief report summarises some of the key themes that have emerged in our research and conversations with industry experts that help to explain SDA vacancies.